We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it

79% Of Employers Regret Background Checks for 1 Reason (How To Avoid It)

Written by Background Check Repair

Written by Background Check Repair

Background Checks | January 17, 2024

Table of Contents

Approximately 79 percent of employers regret performing background checks for an extremely costly reason… which could easily be avoided.

This number may sound startling, given that background checks are becoming the norm for almost all companies hiring for salary positions, and the costs associated with performing background checks is regularly outweighed by the information they provide.

But, in a recent occupational fraud survey, conducted by the Association of Certified Fraud Examiners, findings showed that 79% of victimized employers who conducted background checks found no red flags, resulting in expensive criminal activity.1

Indeed, in a recent study, at least 75 percent of Americans have admitted to stealing from their employers at least once.4

Since this led to theft and fraud that caused an average of loss of nearly $50 billion a year, and trillions of dollars globally, many business owners wonder what can be done to prevent it?

Savvy companies know that using data statistics and hiring trends with background checks can provide key information during the hiring process, which leads to increasing employee morale, performance and overall productivity when used in conjunction with actionable insights.

By understanding the current employment data and background check mistakes companies make, anyone can positively impact their current revenue streams and reduce costly employee turnover while mitigating the risk of occupational theft.

Employment Background Check Data: Current Trends

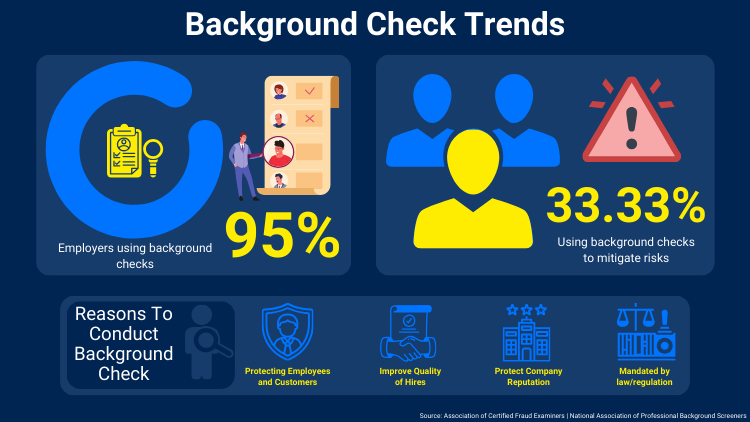

Although the numbers vary, an estimated over 95% percent of employers are now utilizing background checks as part of the hiring process,2 and according to sources, one third of those companies use background checks to specifically mitigate risk.1

This is happening even among industries that aren’t legally required to conduct fingerprint background checks for employment or professional certification, such as health and childcare, real estate or education.

Why? Because background checks work.

They illuminate falsehoods and protect companies from serious liabilities.

- Over 50% of Americans have admitted to lying on a job application or resume at least once, and of those, one third were not caught.3

- At least 75 percent of Americans have admitted stealing from their employer at least once.4

- Businesses in the U.S. lose $50 billion each year due to occupational theft and fraud.5

- Before stealing from their company, approximately 40 percent of employees demonstrated red flags (internally).6

- Almost half of fraud cases resulted because of a lack of internal controls and/or the override of internal controls.1

However, in the U.S., an estimated one in three people (about 70 million) have a criminal record, making the background check process murky for some applicants and employers.7

These challenges make it imperative that when utilizing background checks for employment, employers:

- Ensure compliance with the regulatory and labor boards

- Ensure that background checks are accurate and reliable

- Follow in-house hiring protocols regarding red flags before and after hiring

The most difficult best practice (and costly when ignored) is number three.

When employers ignore red flags on background checks, the resulting criminal misappropriation of funds, theft, and injury that can occur can be staggering.

Globally, the cost of occupational fraud and theft loss is projected at $4.7 trillion annually.

Employee Fraud and Criminal Activity Costs

Background checks can help illuminate issues with personnel that might lead to organizational fraud, theft, and other costly incidents, such as time off and injuries.

Employees account for approximately 90 percent of all theft losses.8

Almost 21 million Americans exhibit at least one addiction, and substance abusers have higher absentee rates and injury claims among workers.9

Forty-three percent of organizations that experienced occupational fraud did not conduct a background check prior to hiring the individual.

And of the remaining surveyed, 21 percent of organizations ignored red flags on the background check and hired the individual anyway.

Ignoring red flags during the hiring process results in significant monetary loss.

Median Losses by Industry and Department Through Occupational Fruad

Not all industries are impacted by occupational fraud equally.

According to fraud data, Real Estate and Wholesale Trade topped the charts in the amount of losses experienced each year.

| Industry | Median Loss Amount |

| Real Estate | $435,000 |

| Wholesale Trade | $400,000 |

| Transportation and Warehousing | $250,000 |

| Construction | $203,000 |

Regrettably, 19 percent of companies failed to modify their anti-fraud controls after being victimized.

Nearly half of all fraud cases were conducted through these four departments:

- Operations

- Accounting

- Executive/C-Level

- Sales

And, 94 percent of criminal perpetrators had no prior fraud convictions.1

Costs of Employee Theft and Fraud

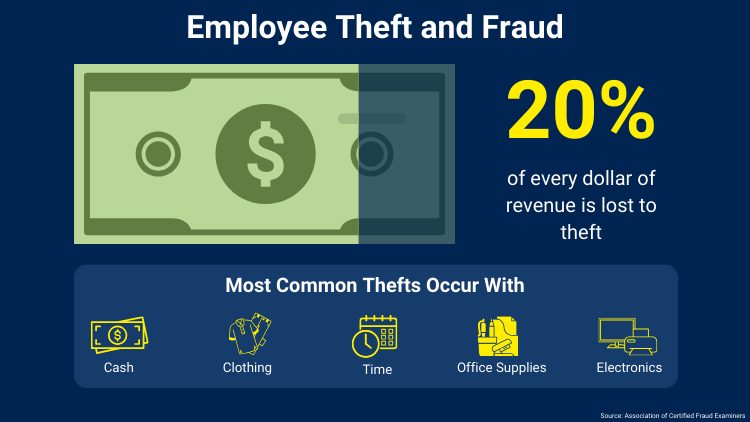

The costs of employee theft can be heavy, with research suggesting that 20 percent of every dollar of revenue is lost to theft.1

In the U.S. alone, businesses lose $137 million each day.

The most common thefts occur with:

- Cash

- Clothing

- Time

- Office Supplies

- Electronics

Demographically, men are the highest number of perpetrators of occupational fraud, being responsible for nearly three-quarters of cases.

Managers committed 39 percent, staff 37 percent, while executives and owners were responsible for 23 percent of cases. The remaining 2 percent of fraud was carried out by others who had access to funds, documents, or other internal operations.

Employee Behavioral Red Flags: What To Look For

Before occupational fraud occurs, employees typically demonstrate behaviors that indicate possible criminal activity.

There are at least five major behavioral red flags that can warn companies of potential theft or fraud.

And, at least one red flag was discovered in over 75 percent of occupational fraud cases.1

- Living Beyond Current Means: This is the most common red flag of potential fraud.

- Strangely Close Relationships with Suppliers, Vendors or Customers

- Defensiveness, Irritability and Secretive Behaviors

- Family Problems

- Fear of Cuts, Job Loss, or Denied Raise/Promotion

Avoiding Mistakes: Making Background Checks Work

Since background checks can (and do) provide critical hiring information, maximizing the data they provide is the first step to preventing costly turnover, occupational fraud and employee thefts.

The Society for Human Resource Management (SHRM) monitors background check usage and violations. Recent rule changes mean that employers must stay on top of current laws to ensure compliance and prevent expensive liabilities.10

The following best practices, outlined by SHRM and the National Institute of Corrections,11 can ensure that background checks comply with local, state and federal regulation, but also help eliminate avoidable costs related to high turnover, theft and occupational fraud.

1. Develop strong internal controls for both relevant screening for criminal convictions based on job position, and red flag monitoring of current employees.

2. Develop and maintain regular updates for background check requirements, especially including adverse action letters and notices. A good rule of thumb is to examine and update background check policies every 4-6 months that comply with the Fair Credit Reporting Act (FCRA) and are based on the Equal Employment Opportunity Commission’s (EEOC’s) guidelines on hiring (or taking adverse action against) individuals with criminal backgrounds.12

3. Choose approved Consumer Reporting Agencies to perform the background checks and ensure that the following forms are provided:

- Disclosure/release form to perform the check

- Disclosure of the screening company/reporting agency to be employed

- Authorization from the applicant and acknowledgment of permission to perform the background check

- Any additional state or local municipality disclosures, releases or notices required

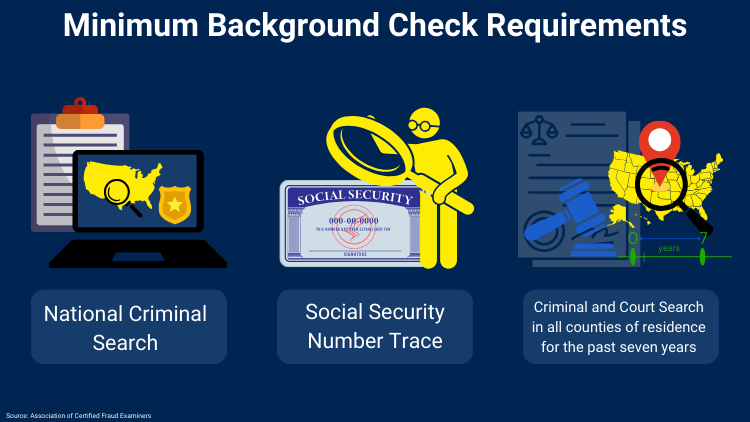

4. Ensure that the minimum background check includes a national criminal search, social security number trace, and criminal and court search of every county where the applicant has resided in the last seven years.

5. Remove mandatory “pass” background check hiring conditions in job offer wording. And, only perform background checks after a conditional offer is provided to avoid violating ban the box laws, which are being passed around the country.

By understanding the latest data insights on background check usage in relation to occupational fraud, companies can use these powerful tools to reduce lost time, employee turnover, theft and potentially dangerous injuries in the workplace.

And, those are some things they’ll never regret.

References

1Association of Certified Fraud Examiners. (2022). A Report to the nations® A Report to the nations®. Amazon AWS. Retrieved December 1, 2023, from <https://acfepublic.s3.us-west-2.amazonaws.com/2022+Report+to+the+Nations.pdf>

2National Association of Professional Background Screeners. (2018, May). How Human Resource Professionals View the Use and Effectiveness of Background Screening Methods. HR.com. Retrieved December 1, 2023, from <https://pubs.thepbsa.org/pub.cfm?id=9E5ED85F-C257-C289-9E8E-A7C7A8C58D00>

3Fennell, A. (2023). Study: Fake job references and resume lies. StandOut CV. Retrieved December 1, 2023, from <https://standout-cv.com/usa/study-fake-job-references-resume-lies>

4Walker, I. (2018, December 28). Your Employees Are Probably Stealing From You. Here Are Five Ways To Put An End To It. Forbes. Retrieved December 1, 2023, from <https://www.forbes.com/sites/ivywalker/2018/12/28/your-employees-are-probably-stealing-from-you-here-are-five-ways-to-put-an-end-to-it/?sh=12af1a863386>

5Pofeldt, E. (2017, September 12). Workplace crime costs US businesses $50 billion a year. CNBC. Retrieved December 1, 2023, from <https://www.cnbc.com/2017/09/12/workplace-crime-costs-us-businesses-50-billion-a-year.html>

6Wilkie, D. (2019, March 4). Why Is Workplace Theft on the Rise? SHRM. Retrieved December 1, 2023, from <https://www.shrm.org/resourcesandtools/hr-topics/employee-relations/pages/workplace-theft-on-the-rise-.aspx>

7Arnold, C. (2021, April 27). Nearly 70 million Americans have criminal records. We must give them a second chance. CNN. Retrieved December 1, 2023, from <https://edition.cnn.com/2021/04/27/perspectives/second-chance-hiring-dimon/index.html>

8Ragin, D. M., Kaye, T., (Nathan Pham), N., Antle, A., & Scott, M. (2016, April 18). Crime/Employee Theft. Temple MIS. Retrieved December 1, 2023, from <https://community.mis.temple.edu/tkaye/files/2017/08/RMI-2901-Part-2-submission.pdf>

9Yerby, N. (2023, November 2). Addiction Statistics – Facts On Drug And Alcohol Use. Addiction Center. Retrieved December 1, 2023, from <https://www.addictioncenter.com/addiction/addiction-statistics/>

10Smith, A. (2021, September 11). Background-Screening Rules Keep Employers on Their Toes. SHRM. Retrieved December 2, 2023, from <https://www.shrm.org/resourcesandtools/legal-and-compliance/employment-law/pages/background-screening-rules-keep-employers-on-their-toes.aspx>

11National Institute of Corrections. (2023). Best Practice Standards: The Proper Use of Criminal Records in Hiring. National Institute of Corrections. Retrieved December 2, 2023, from <https://nicic.gov/resources/nic-library/all-library-items/best-practice-standards-proper-use-criminal-records-hiring>

12Equal Employment Opportunity Commission. (2023). Background Checks | U.S. Equal Employment Opportunity Commission. Retrieved December 2, 2023, from <https://www.eeoc.gov/background-checks>