We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it

Does a Background Check Include Tax Records?

Written by Background Check Repair

Written by Background Check Repair

Background Checks | May 10, 2024

Table of Contents

Having an employer run a background check is a common procedure when being considered for employment, but does a background check include tax records? This is a good question, with somewhat of a tricky answer.

Are Taxes Always Used for Background Checks?

Generally speaking, taxes and background checks don’t always go hand in hand. However, there are a few times when you should expect a background check to include your tax returns.

Most employers only require a basic background check. Checking your tax records is not very common for a majority of entry-level positions, but it really depends on the level of background checks your employer chooses. In other words, what it includes will depend on the information listed below.

Understanding the Various Levels of Background Checks

There are different levels of background checks an employer may choose, and what a records search reveals will differ depending on the type. These levels vary depending on the requirements of the company and state background check laws, but most are fairly similar from state to state. The type of job you are applying for will also determine what level of background checks and record checks an employer may request.

When Does a Background Check Include Taxes?

A background check is only going to include taxes under certain circumstances. There are some cases when information about your taxes may surface, like having a current or previous tax lien on your credit report or county records, which we talk about in more detail later.

Also, the duration of a background screening will not differ when tax records are included vs not.

Level 1 Background Checks

A Level 1 check is going to be your basic background screening for a low or entry-level job. These aren’t as in-depth as Level 2 screenings, but they do take a look at a lot of different background records as part of the screening process. They include employment verification checks, criminal correspondence checks at the state level, sex offender reporting, and potentially criminal records checks through local law enforcement systems. Level 1 background checks do not usually include tax records.

However, are police records included as part of level 1 screenings? Yes, but only local police reports that lead to actual convictions or pending charges.

Level 2 Background Checks

Level 2 checks are only officially defined in the state of Florida, though they are used across the country for other states as well.

According to Florida Statute 435.04, a Level 2 background check will dive much deeper into state and federal records as part of the screening process.1 Level 2 background checks include everything from Level 1 background checks, which as mentioned above don’t usually include your taxes, plus a national criminal history records check that is processed through the Federal Bureau of Investigation.

When a Job Might Check Your Record for Any Criminal Issues (Including a Check for Tax Problems)

A job that involves people who are vulnerable like the elderly or children will require this check of vital documents. Keep in mind that level 2 checks are used in all states; it’s just that Florida is the only state with an official definition.

One key thing to note is that for level 2 background checks (including tax records) fingerprints are required. In other words, you will need to have your prints taken by local authorities as part of the background check submission process. This means that tax issues in any county and state in the country could show up.

Lastly, a level 2 background check is commonly required for a US police clearance document.

FBI Background Check

FBI background checks are very thorough and can include your tax history, especially if you’ve ever been convicted of any sort of tax fraud or tax-related crime. Your employer will sometimes tell you if you’re going through an FBI background check, but you’ll know for sure if you need to electronically submit your fingerprints to be run through the FBI’s national database.

However, FBI background checks are typically reserved for careers within federal and governmental agencies, such as law enforcement or municipal positions.

Tax Records Background Checks: How Do They Work?

A tax background check on the other hand looks specifically at your taxes. This is very rare for an employer to request. If it is requested, the employee is usually required to submit tax records personally, as the IRS considers your tax returns to be strictly confidential.

There are specific forms you will be asked to file with the IRS which will release your tax information to requesting parties. This is common when acquiring a large loan such as during a high-profile renter’s background screening for luxury properties.

There are also times when background checks for certain positions, like those that involve handling large sums of money or having access to high levels of confidential information, may require financial checks that may include tax returns. Tax evasion, for example, is a disqualifying offense for jobs where employees will have access to tax information.

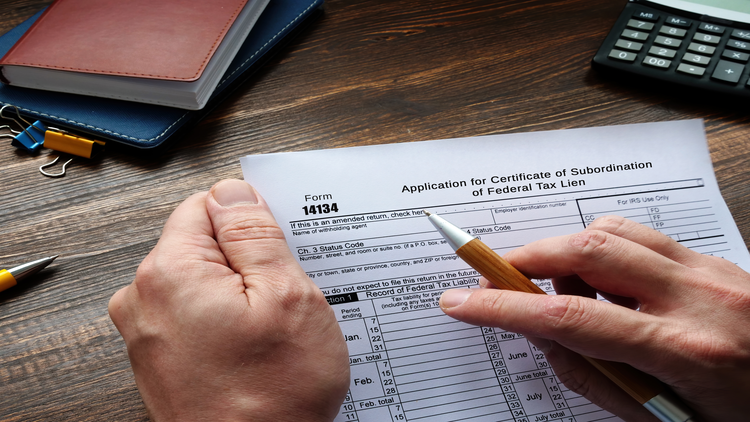

Tax Lien Background Check Information

Do tax liens show up on background checks?

As we mentioned earlier, the type of background check an employer chooses can determine if it will include your tax information. How much you owe can also affect whether or not they will include tax liens in your background check information.

Keep in mind that federal tax liens are a serious problem and can lead to the seizure of your assets. In most real-world scenarios, hiding this from an employer or those looking into your background history will be nearly impossible.

If you think this may apply to you, it’s important to use a no-cost criminal history search as soon as possible to understand what convictions you may be facing which could even lead to active warrants for your arrest depending on the circumstances of the lien.

If you owe $10,000 or more, it will show up (more details below).

Are Tax Fraud Background Checks Different?

Tax fraud is a crime, so a tax fraud background check is effectively the same as a criminal background check. If you’ve been convicted of tax fraud, it will show up under a criminal background check as part of employment screening.

Put another way, if you have been convicted of tax fraud, including being summoned to court over a tax issue and there are public court records regarding your case, those records may show up in even a basic background check.

How Long Do Tax Records Stay on a Background Check?

Tax records in general aren’t included in background checks but can be under the circumstances we’ve covered. Tax crimes will remain on a criminal record unless they’re removed for some reason.

Tax liens will stay on your credit report and most county databases for 7 years. This makes it a safe bet to expect those types of tax records to stay on a background check for at least 7 years.

Can Employers See Background Check Tax Returns?

Employers are most likely only going to see tax returns from your background check if you’re undergoing a thorough federal background check for one of the reasons we’ve discussed.

That can include having a high-security clearance, handling a lot of money, or working with tax information. Tax liens are usually only seen on background checks where the liens are in excess of $10,000, and consequently appear on your credit report or listed in local public records.

In the cases where background checks don’t show your tax returns and you do owe something like a tax lien, your employer may still be able to find out. The IRS has the authority to garnish wages from your salary.2 If this happened, it would immediately let your employer know you have tax troubles the moment they started payroll.

Does a High-level Job Go Back Further Than 7 Years?

If the job involves any position within the government, an FBI check might be used along with fingerprints. In this case, your entire history would show up.

Otherwise, records only go back 7 years (and up to 10 years in special circumstances).

There are only 3 states where a check for taxes will go back 10 years:

- Alaska

- Michigan

- Indiana

Do They Stay on Your Record Longer if You’re a Convicted Criminal?

The length of time these tax records will show up for any applicant is not related to previous criminal convictions. Each offense is “stand-alone” and will have its own timeline, following the rules mentioned above.

How Do I Correct Background Check Tax Records?

First, you need to do a background check on yourself with a reputable agency. If you are correcting records for others first you will need to use a method to search for the person’s middle name.

However, if you choose to do all of the paperwork yourself and use a free criminal background check and your tax records indicate something false or something you don’t recognize like convictions or pending charges, it’s important to get it sorted out right away and cover yourself from further issues.

If your credit report is showing a lien that’s already been paid off you can take care of it yourself with two simple steps:

- Start by getting your payment confirmation from the IRS.

- Then contact the major credit bureaus and present your proof of payment to have it removed.

The same would go for dealing with county and state tax records.

Finding Your IRS Tax Records

It’s a good idea to get copies of your credit reports every year even if you’re not applying to jobs, but it’s also important to obtain copies of your IRS records every once in a while too.

This way you can make sure everything is matching up each year, and can help avoid any future tax liens or complications if you owe anything. Thankfully the IRS has made finding IRS records easy. You can request your tax history and learn more about tax records on their site.3

References

1Florida Legislature. (2024). The 2023 Florida Statutes Ch. 435. Online Sunshine. Retrieved May 2, 2024, from <http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0400-0499/0435/Sections/0435.04.html>

2Internal Revenue Service. (2024, March 29). Levy. IRS. Retrieved May 2, 2024, from <https://www.irs.gov/businesses/small-businesses-self-employed/levy>

3Internal Revenue Service. (2024, April 25). Routine Access to IRS Records. IRS. Retrieved May 2, 2024, from <https://www.irs.gov/privacy-disclosure/routine-access-to-irs-records>