Knowing how to find bankruptcies on public records can be beneficial for a number of reasons, especially when learning how to search for public records, bankruptcies free.

Since bankruptcies are filed in federal court, a record of the case is available for lookup on the PACER system. But, with a little digging, anyone can learn where to perform a free bankruptcy search, namely in the local news and by getting a free credit report.

The following guide provides detailed information on how to find bankruptcies on public records, where exactly to look for the free methods and those that may have small charges associated with them, and how each state deals with financial court records.

How To Look Up Bankruptcies for Free

The ‘free’ methods for finding bankruptcies are limited, but that doesn’t mean they don’t exist.

At least two ways allow anyone to look up bankruptcies for free:

- Run A Free Credit Report

- Check Local News Outlets

If someone is looking up their own bankruptcy (performing a federal records check on yourself), it will be listed (once a judgment has been issued) on their personal credit report. The U.S. government guarantees that any citizen may obtain a free credit report once each year.

However, when looking up other bankruptcies, the free method involves searching local news outlets. Many towns and municipalities post bankruptcies on a daily basis. To conduct the search, follow these steps:

Step 1. Google the name of the town and the word “bankruptcies.”

Step 2. Filter all results that are ads, and look for newspaper articles or “public filings” with a .gov address.

Step 3. Explore the results pages.

This method isn’t 100 percent effective, because it depends on a news outlet or government entity posting bankruptcy notices.

Is Bankruptcy Public Record?

Many people who are doing their due diligence on a potential financial advisor or those who are considering declaring bankruptcy themselves may be wondering if bankruptcies are public records.

The answer is yes, bankruptcies are considered public records and thus are subject to the Freedom of Information Act.

Like virtually any case that goes through the United States court system, bankruptcy filings are available to the public, since the case was seen by a judge.

Like other court records (for example, digging up charges on someone), these reports are available to search.

All legal filings, such as criminal cases or divorce filings, and bankruptcy cases must be filed through court and the subsequent documents are public records.

Keep in mind that, although uncommon, some smaller jurisdictions may publish bankruptcy filings in the local newspaper. However, even in small towns, this is uncommon. For more information about how bankruptcy filings are published, individuals should talk to an attorney who specializes in bankruptcy cases for more detailed information about their jurisdiction.

Accessing Public Records: Bankruptcies (Free)

To the average person, there will be two main methods available to search public bankruptcy records themselves.

Besides the two DIY methods which are discussed in detail below, there is also the option of hiring a background check agency to perform this search. Most background check agencies simply search all available public records on an individual, and bankruptcy records will show up as part of many background checks.

Although hiring a background check company may seem expensive, many offers discounted or even no-cost trial background screenings, in order to learn this information for little to no cost.

How To Find Bankruptcies on Public Records Using PACER (Public Access to Court Electronic Records)

Using the PACER system is by far the easiest and quickest way to find bankruptcy records…and it is very inexpensive. About a dime for each search. The Public Access to Court Electronic Records system (PACER) is maintained by the US Courts and contains case information for virtually any federal court case. The only exception is cases that are sealed, which is fairly rare.

Detailed steps to use the PACER system are outlined below.

Step 1. Access the PACER website

The PACER website is a great resource for all things related to federal court cases in the United States. Besides allowing users to search court cases, individuals can also file cases electronically through the website.

Step 2. Create an Account

In order to perform a search of the PACER system, individuals must first create an account using their personal information. The registration process is very simple and only requires some basic information from the individuals such as an address, name, date of birth, etc. Creating an account is completely free but performing searches carries a small fee. During the registration process be sure to add credit card information so that searches can be completed as soon as possible.

Although it may seem unnecessary, many databases that deal with public records require individuals to create accounts so that the agency in charge can be aware of who is accessing public records for various legal reasons. Although this sounds intimidating, public records are exactly that, public, and searching for any public record is totally legal, whether it is your own public record or it belongs to a complete stranger.

Step 3. Perform Search

With an account created and a payment method added, the only thing left to do is perform the search. The user manual is a great resource for those with more unique or complex searches, however, most individuals should have no problem performing a search. There are a couple of different ways to perform a search, based on what information the individual has, such as a case number, and what information they need.

Step 4. Performing Searches by a Specific Court

Many individuals who are trying to find bankruptcy information on someone else will have the best luck searching by a specific court. As long as the location of where the case would have taken place is known, individuals can immediately narrow down their search by selecting to search for cases through a specific court.

The best way to do this is to use the Court CM/ECF Lookup function on the PACER website, then search the state where the individual resides, such as California. This will yield results for all the federal district courts in California.

Bankruptcy courts are their own courts so it should be fairly easy to locate the specific court that has the documents in question. Individuals who are unsure which federal court district to choose can simply click one of the courts and look at the list of counties that are in that district. For example, The California Central Bankruptcy Court includes the following counties:

- Los Angeles

- Orange

- Riverside

- San Bernardino

- San Luis Obispo

- Santa Barbara

- Ventura

If the individual resides in any of these counties, their bankruptcy would have been filed in the California Central Bankruptcy Court

Once the proper court has been identified, simply use the PACER system to find any files associated with a specific individual.

Step 5. Search by National Index

Another search option that may work well for many individuals is performing a search by national index. Opposed to other searches, which require the specific court to find documents, the national index has files and documents from all federal courts. This search will include bankruptcy courts as well as appellate and district courts.

The national index search also allows users to save searches and cases for easy access later on. This is especially useful for individuals who are performing searches on multiple people and would like to access the information they have found quickly.

Finally, the national index search is also useful for individuals trying to find bankruptcy information, without a lot of supporting information. For example, it can be otherwise difficult to find bankruptcy files on individuals who have had multiple addresses in the last few years or for individuals whose exact address is not known.

The national index search allows users to perform advanced searches and narrow down certain criteria to obtain better results. Individuals are able to narrow down a search by a certain region, only including certain federal court districts. There are also options to perform searches based on a specific time frame.

For example, if someone is trying to find out bankruptcy information but only knows that the individual lived in Alabama from 2012 until 2018, they can narrow down search results to only show court documents from the two Alabama federal districts in that time range.

This allows individuals to be far more certain of their findings, rather than risk missing important information on someone because they were unaware that they lived in a different county for a few years before relocating.

As with all searches of the PACER system, users are still required to register and be signed into an account in order to perform a search.

Step 6. Cost

The cost of documents will vary based on a few different factors. Mainly whether or not official copies are needed. However, no matter what the document is, the fee will never exceed $3 for a single document. Most documents are far cheaper and a typical search can be completed for as little as $0.10.

Search Public Access to Electronic Court Records by State

All bankruptcies in the United States are handled by federal courts, and because of this, bankruptcy filings will not be present when searching for records through local courts. The US court system does provide a search function on its website.

This can be used to locate the nearest bankruptcy court, however, this is mostly used for individuals looking to file bankruptcy themselves, rather than to find out about bankruptcies that were potentially filed by other individuals.

How To Find Court Records on a Person (State and Local Jurisdictions)

Although bankruptcy records will only be available through federal courts, there is still a wealth of useful information that can be obtained through local courts. Although not every jurisdiction will have an online searchable court database, many larger metropolitan areas will.

The process on how to find and search local court records will vary slightly from state to state and by county. The below example should provide the basic steps on how to find local court information anywhere in the country, assuming the jurisdiction has digitized files that are available online.

Step 1. Access the Local Court Clerk’s Website

Finding the website of the local court should be fairly easy for most counties. A simple Google search of the county name followed by “court records,” should get individuals pointed in the right direction.

For example, a search of “Hennepin County Court Records,” will yield the official Minnesota State Court search website.

From there, users only need to select the “Access Court Records,” link at the top of the website’s homepage.

Step 2. Perform Search Using Specific Instructions

The specific steps to perform the search will vary based on the website’s layout and other factors. Many jurisdictions will require users to create an account in order to perform their search, whereas others will only require a fee.

Keep in mind that almost all jurisdictions will have a fee associated with performing a search, or at the very least, a fee for obtaining official copies of court documents.

For example, for how to find records in Minnesota, users will need to access the Minnesota Public Access Remote (MPA Remote) and then select the kind of case they are searching for. This will take users to the website where searches can be performed.

Searches are free and require the case number in order to perform the search. Fees are associated with obtaining official copies which will be mailed to the individual and are not currently available electronically.

For individuals who need to know how to find to access to local court records for courts that do not have online files that are accessible to the public, steps will vary significantly. The best plan of action for these jurisdictions is to locate the number of the local court clerk, which can often be found on the court or county website, and ask them directly.

In some cases, they may be able to take records, request information over the phone, or will direct individuals to a specific form that can be filled out and mailed.

Finally, going to the courthouse in person is also effective as individuals can often talk to the clerk directly or use a public access computer which will often have a searchable court record database available.

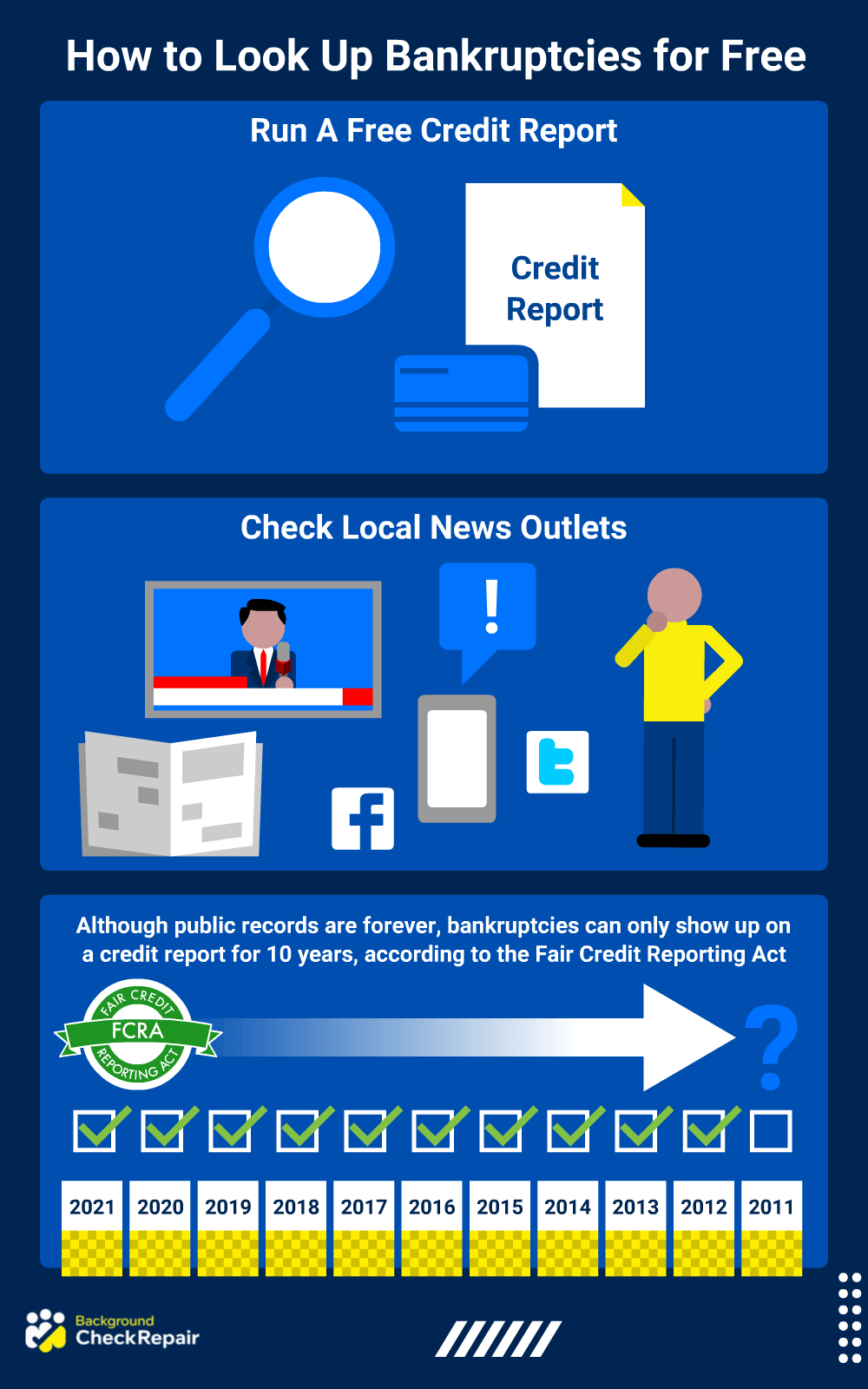

How Long Are Bankruptcies Public Record?

Like all public records, bankruptcies will remain public records forever, which can be a good thing when it comes to how to find bankruptcies on public records. In extremely rare cases a bankruptcy record will be sealed and not available to the public but this is only done in extreme circumstances. Once bankruptcy is filed, it will be available to the public via court records forever.

Although public records are forever, bankruptcies can only show up on a credit report for 10 years, according to the Fair Credit Reporting Act.

State Bankruptcy Exemptions

Although bankruptcies are tried in federal courts, state laws can dictate certain bankruptcy exemptions. Understanding exemptions can be confusing but is incredibly important. Exemptions will determine what individuals are able to keep possession of during and after a bankruptcy filing. Exemptions are not only specific to the jurisdiction but also to the type of bankruptcy that is being declared.

Where things can get especially confusing is for individuals who live in states that allow those filing for bankruptcy to use either the state OR federal exemptions. These states are:

- Alaska

- Arkansas

- Connecticut

- District of Columbia

- Hawaii

- Kentucky

- Massachusetts

- Michigan

- Minnesota

- New Hampshire

- New Jersey

- New Mexico

- New York

- Oregon

- Pennsylvania

- Rhode Island

- Texas

- Vermont

- Washington

- Wisconsin

In these states, individuals need to fully understand both the state bankruptcy exemptions and the federal bankruptcy exemptions for the type of bankruptcy that they are filing. This will allow individuals to pick which exemptions work best for their unique situation.

Cars, houses, pensions, checking accounts, and savings accounts, are just some of the things that can be exempted under various federal and state laws for bankruptcies. Although bankruptcy has a reputation for causing individuals to lose everything they own, this is often far from reality. In many cases, individuals will declare bankruptcy so that they don’t lose everything.

Understanding bankruptcy exemptions can be the difference between an individual losing their car and house or being able to keep them once the bankruptcy has been filed.

Bankruptcy exemptions are extremely specific and confusing, it is best to consult a lawyer to better understand local bankruptcy laws and exemptions. Starting with the exemptions below is a good place to start but consulting an attorney is highly recommended.

Knowing the options for exemptions, how to find public records bankruptcies free, and how to find bankruptcies on public records provides an easy way to search the records that potential employers, financial institutions, and other searchers will see.

Frequently Asked Questions About How To Find Bankruptcies on Public Records