Car accidents are significant stressors for most people, particularly because they aren’t always preventable and can have repercussions down the road, leaving many people asking, does a no fault accident go on your record?

Not exactly.

No-fault accidents should not show up on criminal records, but they almost always show up on driving records.

But, what does this mean for employment? If you’re applying for a job that involves driving, an accident could show up on a background check that examines your driving record. Find out right now by searching free criminal records lookup to see if it shows up.

This guide explains how to find the answer to, does a no fault accident go on your record, and which states have various laws preventing this type of record from harming your record.

Does a No Fault Accident Go on Your Record?

What many people want to know is “Does a no fault accident go on your record?” The answer: not exactly. Oftentimes, when people talk about their records, they are referring to their criminal history record. A no-fault accident should never show up on a person’s criminal record.

Every state has various agencies and Departments that determine the penalties and punishments related to driving accidents, and in Alabama, the Department of Insurance outlines the “no fault” rules of the state.

However, just like any other car accident, a no-fault accident will almost always show up on an individual’s driving record.

When Does a No Fault Accident Go on Your Record?

In answer to the question “When does a no fault accident go on your record?”: a no-fault accident goes on your driving record the moment it is reported to the DMV. Accidents are reported to the DMV:3

- When police are called to the scene

- When someone is injured or damages are greater than $1,000 (many states require the individual to report in these circumstances)

- When an insurance claim is filed (sometimes)20

Typically, only the most minor fender benders may be settled without the filing of a DMV report.

Does a No Fault Accident Go on Your Record?

Knowing that some states are no-fault states while others are tort states, individuals are likely to wonder “Does a no fault accident go on your record in each state?” This is a good question, and a difficult one to answer.

In “tort” states, there is technically no such thing as a “no-fault accident,” but there are plenty of accidents where one party was not at fault. The not-at-fault party can expect to see the accident on their driving record if it was more than a minor fender bender and if police or insurance was contacted.

In “no-fault” states, individuals must file claims with their own insurance companies for personal injury, which further increases the likelihood of the accident going on their MVR report. So, in essence, a no-fault accident will appear on driving records in each state.

| Does a No Fault Accident Go on Your Record in Each State? | Laws for No Fault Accidents |

| Alabama | AL is a “fault” state. Victims have a specific number of years to file damage claims after an accident and the accident goes on the record. Alabama Code Title 32 |

| Alaska | AK is a “fault” state. A claim should be filed within 2 years after the accident. Alaska Statutes Title 9 |

| Arizona | AZ is a “fault” state. Damage claims can be filed for a specific number of years after an accident. Arizona Revised Statutes 12-542 |

| Arkansas | AR is a “fault” state. Victims have a 3-year deadline for the filing of damage claims/lawsuits. Arkansas Code section 16-56-105 |

| California | CA is a “fault” state. There is a specific number of years to file damage claims/lawsuits. California Code of Civil Procedure Section 335.1 |

| Colorado | CO is a “fault” state. Victims should file damage claims within 3 years after the accident. Colorado Revised Statutes section 13-80-101 |

| Connecticut | CT is a “fault” state. Damage claims should be filed within a specific number of years after an accident. Connecticut General Statutes Section 52-584 |

| Delaware | DE is a “fault” state. Victims have 2 years after the accident to file for damage claims. Delaware Code Title 10, Section 8119 |

| Florida | FL is a “no-fault” state. Claims can be filed within 4 years from the accident. Florida Statutes Section 95.11(3)(a) |

| Georgia | GA is a “fault” state. Damage claims should be filed within 2 years after the accident. Georgia Code Section 9-3-33 |

| Hawaii | HI is a “no-fault” state. Claims can be filed within 2 years from the accident. Hawaii Revised Statutes Section 657-7 |

| Idaho | ID is a “fault” state. Lawsuits for injury should be filed within 2 years from the accident. Vehicle damage claims should be filed within 3 years. Idaho Statutes section 5-219 |

| Illinois | IL is a “fault” state. Damage claims can be filed for a specific number of years after an accident. 735 Illinois Compiled Statutes section 5/13-202 |

| Indiana | IN is a “fault” state. A claim should be filed within 2 years after the accident. Indiana Code section 34-11-2-4 |

| Iowa | IA is a “fault” state. Lawsuits for injury should be filed within 2 years from the accident. Vehicle damage claims should be filed within 5 years. Iowa Code Section 614.1 |

| Kansas | KS is a “no-fault” state. Victims have a specific number of years to file damage claims after an accident and the accident goes on the record. Kansas Statutes Section 60-513 |

| Kentucky | KY is either a “fault” or “no-fault” state. Victims are given the option of choosing no-fault or the traditional insurance. But claims can be filed within 2 years after the accident. Kentucky Revised Statutes Section 304.39-230 |

| Louisiana | LA is a “fault” state. Victims have a 1-year deadline for the filing of damage claims/lawsuits. Louisiana Civil Code Article 3492 |

| Maine | ME is a “fault” state. Damage claims should be filed within 6 years after the accident. Maine Revised Statutes Title 14, Section 752 |

| Maryland | MD is a “fault” state. Claims can be filed within 3 years from the accident. Maryland Courts & Judicial Proceedings Code section 5-101 |

| Massachusetts | MA is a “no-fault” state. Lawsuits for injury and damage claims should be filed within 3 years from the accident. Massachusetts General Laws Chapter 260 section 2A |

| Michigan | MI is a “no-fault” state. Victims should file damage claims within 3 years after the accident. Michigan Compiled Laws section 600.5805 |

| Minnesota | MN is a “no-fault” state. Damage claims should be filed within 2 years after the accident. Minnesota Statutes Section 541.07 |

| Mississippi | MS is a “fault” state. Victims should file damage claims within 3 years after the accident. Mississippi Code Section 15-1-49 |

| Missouri | MO is a “fault” state. Lawsuits for injury and damage claims should be filed within 5 years from the accident. Missouri Revised Statutes Section 516.120 |

| Montana | MT is a “fault” state. Lawsuits for injury should be filed within 3 years from the accident. Vehicle damage claims should be filed within 2 years. Montana Code section 27-2-204 |

| Nebraska | NE is a “fault” state. Claims can be filed within 4 years from the accident. Nebraska Revised Statute 25-207 |

| Nevada | NV is a “fault” state. Injury lawsuits should be filed within 2 years from the accident. Vehicle damage claims should be filed within 3 years. Nevada Revised Statutes Section 11.190 |

| New Hampshire | NH is a “fault” state. Claims can be filed within 3 years from the accident. New Hampshire Revised Statutes Section 508:4 |

| New Jersey | NJ is either a “fault” or “no-fault” state. Victims are given the option of choosing no-fault or the traditional insurance. Damage claims can be filed for a specific number of years after an accident. New Jersey Statutes Section 2A:14-2 |

| New Mexico | NM is a “fault” state. Injury lawsuits should be filed within 3 years from the accident. Vehicle damage claims should be filed within 4 years. New Mexico Statutes Annotated Section 37-1-8 |

| New York | NY is a “no-fault” state. Lawsuits for injury and damage claims should be filed within 3 years from the accident. New York Civil Practice Laws & Rules Section 214 |

| North Carolina | NC is a “fault” state. Victims have 3 years after the accident to file for damage claims. North Carolina General Statutes Section 1-52 |

| North Dakota | ND is a “no-fault” state. Damage claims should be filed within 6 years after the accident. North Dakota Century Code section 28-01-16 |

| Ohio | OH is a “fault” state. Injury lawsuits and damage claims should be filed within 2 years from the accident. Ohio Revised Code section 2305.10 |

| Oklahoma | OK is a “fault” state. Victims should file damage claims within 2 years after the accident. Oklahoma Statutes title 12, Section 95 |

| Oregon | OR is a “fault” state. Lawsuits for injury should be filed within 2 years from the accident. Vehicle damage claims should be filed within 6 years. Oregon Revised Statutes Section 12.110 |

| Pennsylvania | PA is either a “fault” or “no-fault” state. Victims are given the option of choosing no-fault or the traditional insurance. But claims can be filed within 2 years from the accident. 42 Pennsylvania Statutes Section 5524 |

| Rhode Island | RI is a “fault” state. Injury lawsuits should be filed within 3 years from the accident. Vehicle damage claims should be filed within 10 years. Rhode Island General Laws section 9-1-14 |

| South Carolina | SC is a “fault” state. Damage claims should be filed within 3 years after the accident. South Carolina Code Section 15-3-530 |

| South Dakota | SD is a “fault” state. Lawsuits for injury should be filed within 3 years from the accident. Vehicle damage claims should be filed within 6 years. South Dakota Codified Laws section 15-2-14 |

| Tennessee | TN is a “fault” state. Victims have 1 year after the accident to file for damage claims. Tennessee Code section 28-3-104 |

| Texas | TX is a “fault” state. Damage claims should be filed within 2 years after the accident. Texas Civil Practice & Remedies Code section 16.003 |

| Utah | UT is a “no-fault” state. Injury lawsuits should be filed within 4 years from the accident. Vehicle damage claims should be filed within 3 years. Utah Code Section 78B-2-307 |

| Vermont | VT is a “fault” state. Claims can be filed within 3 years from the accident. 12 VT Statutes Section 512 |

| Virginia | VA is a “fault” state. Victims should file damage claims within 2 years after the accident. Code of Virginia Section 8.01-243 |

| Washington | WA is a “fault” state. Damage claims should be filed within 3 years after the accident. Revised Code of Washington Section 4.16.080 |

| West Virginia | WV is a “fault” state. Damage claims should be filed within 3 years after the accident. West Virginia Code Section 55-2-12 |

| Wisconsin | WI is a “fault” state. Victims should file damage claims within 3 years after the accident. Wisconsin Statutes Section 893.54 |

| Wyoming | WY is a “fault” state. Claims can be filed within 4 years from the accident. Wyoming Statutes Section 1-3-105 |

How Long Does a Car Accident Stay on Your Record?

Accident entries are among the most prominent on a driving record and are likely to note any citations associated with the accident.3 Wondering “How long does a car accident stay on your record?”. Well, this depends primarily on the state where the driving record is held and on the type of car accident.

In general, minor accidents can be expected to remain on a driving record for a period of 3 to 5 years.2,17 More severe accidents, such as at-fault accidents where serious injury occurred or drugs/alcohol were involved are likely to stay on a driving record longer, sometimes 10 years or more.11,20

How Long Does a Not At-Fault Accident Stay on Your Record?

Still wondering about no-fault accidents and “How long does a not-at-fault accident stay on your record?” Unfortunately, the same rules generally apply. A not-at-fault accident can be expected to remain on a driving record for about 3 years.20

Do All Accidents Show Up on Your Driving Record?

An individual’s MVR report from the DMV (Division of Motor Vehicles) is a complete history of their driving record, and car accidents are among the most notable incidents to appear on someone’s driving record, begging the question, do all accidents show up on your driving record?

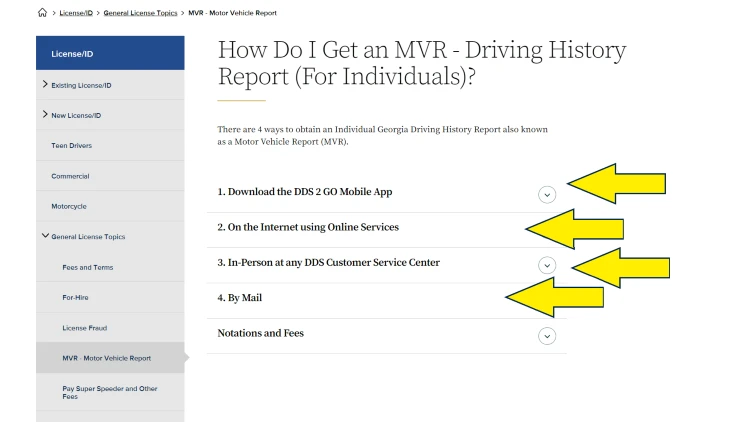

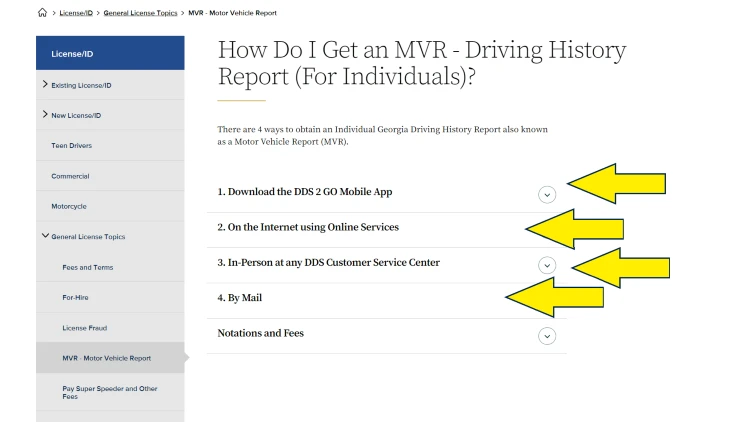

Most states allow drivers to access their personal DMV record using online, in person, or mail requests, and they generally charge a few dollars processing fee.

In reality, the vast majority of accidents will be documented on an individual’s driving record.11 The contributing factors are:

- The severity of the accident

- Who is at fault

- Whether police are called to the scene

- Whether an insurance claim is filed

Accident Severity

The overarching point here is how serious the car accident is. More serious car accidents will result in more damage, a greater likelihood of personal injury, a guaranteed police response, and a higher probability of filing an insurance claim.

Thus, accident severity impacts all other categories. Less severe accidents, such as minor fender benders may be settled by the parties, independent of police and insurance companies, which can prevent their appearing on the driving record. Check state laws on accident reporting as many states require any accident resulting in injury or property damage to be reported.1

Fault

When a person is at fault for an accident, they have less leverage in determining whether to call the police or file an insurance claim. If they are obviously not responsible for the accident, however, and prefer to deal with minor damages out of pocket rather than go through police and insurance, they may be able to come to an arrangement with the other party (though not without risk).20

Police Presence

Calling the police to the scene of an accident will almost always result in a police report, which is typically then submitted to the DMV for driving record purposes. For minor accidents not requiring police assistance or mediation, the incident may go unrecorded by the DMV.

Regardless of whose at fault, contacting the police to create a record of the accident is always a good idea.

However, it is not always within the individual’s power to choose whether to contact police as many concerned bystanders are quick to report accidents, particularly those which impede the flow of traffic.1

Insurance Claim

Insurance companies are not required to report accidents to the DMV, but they sometimes do. Thus, an accident serious enough to warrant an insurance claim by either party is more likely to show up on a driving record.

In summary, most car accidents will show up on an individual’s driving record, especially if the accident is serious and police are called to the scene.

When Does an Accident Go on Your Record?

Many people have asked “When does an accident go on your record?,” and it is helpful to understand the exact point in time when an accident goes on someone’s record. First, the distinction must be made between the two types of records: criminal records and driving records.

When Does an Accident Go on Your Criminal Record?

Car accidents are unlikely to appear on an individual’s criminal record unless they are tied to a criminal offense, such as DUI, reckless driving, hit-and-run, or vehicular manslaughter. In these instances, the car accident may be notated on the associated criminal offense from the point where the individual was either arrested or charged with a crime. However, many car accidents do not have criminal underpinnings and thus do not appear on a criminal record.

Note that hit-and-run is a crime, and therefore, an individual’s behavior following an accident can be as incriminating as the behavior leading up to the accident.

When Does an Accident Go on Your Driving Record?

Most car accidents go on a person’s driving record, whether the person was at fault in the accident or not.20 The accident is typically reported to the DMV for driving record purposes by the police after the police report has been filed. The DMV may also receive information about the accident if the individual receives a ticket associated with the accident (e.g. careless driving).2

Does Speeding Ticket Show Up on Background Check?

Speeding tickets are frightfully common nowadays, and so are background checks, begging the question “Will a background check reveal any records of speeding violations?” Whether a speeding ticket shows up on a background check depends on if the individual requesting the report orders a driving record from the DMV.

Speeding tickets within the last few years will almost certainly show up on the driving record and background checks which access the MVR report. Speeding tickets resulting in a criminal citation will also show up on the criminal record and background checks which investigate criminal history.

Do Traffic Warrants Appear on Background Checks?

A traffic warrant is an order for someone’s arrest as a result of failure to pay traffic fines or answer a court summons. People asking “Are traffic warrants part of background check results?” need to know that traffic warrants do appear on driving records and thus background checks which investigate driving records.

A traffic warrant resulting from a failure to answer a court summons of a misdemeanor traffic violation could potentially show up on a criminal record. It has been known to happen, though it technically shouldn’t.

How Does DMV Find Out About Accidents?

The DMV is the keeper of all driving records including records for fault and no fault accidents, but how does DMV find out about accidents in the first place?

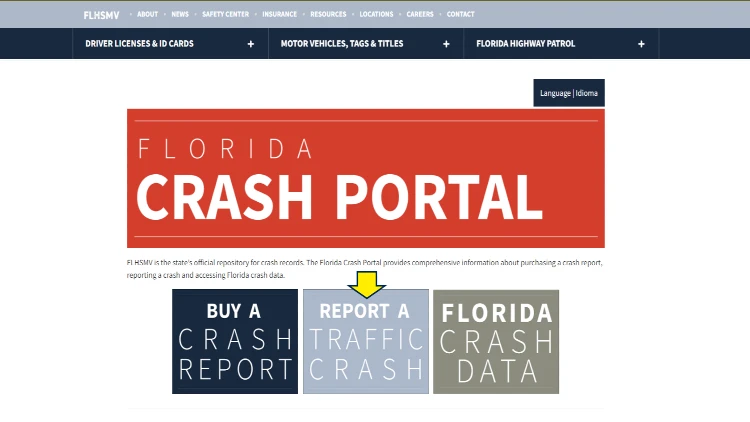

Florida makes it possible to file a traffic crash report online.

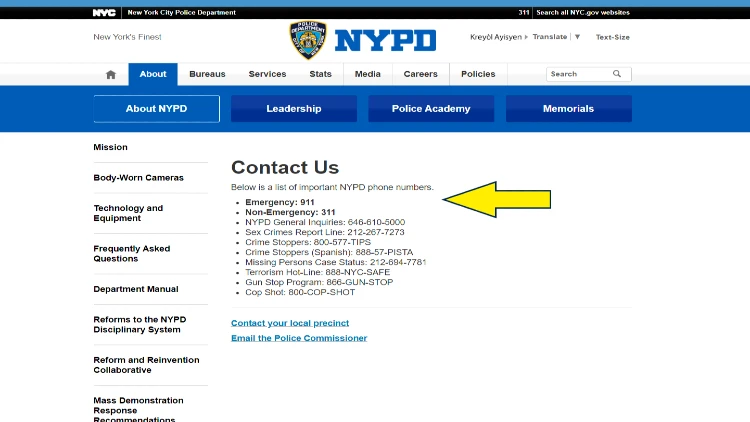

Broadly speaking, there are a few ways this can happen:2

- When police are called to the scene of an accident, they will complete and submit a DMV report.

- In some states, individuals are required to report collisions and accidents to the DMV directly, particularly when accidents cross a state-specified threshold for property damage and injury.

- In some cases, an individual’s insurance agent may report the accident to the DMV, usually when there is some issue with insurance coverage.

For example, in California, individuals (or their representatives) are required to complete and submit a specific form (SR 1 Form) to the State of California Department of Motor Vehicles within 10 days, for all collisions of any magnitude (any injury and/or property damage over $1,000). Penalties apply for failure to submit the SR 1 Form.22,24

Every state operates a bit differently with accident reporting, so be sure to check on reporting criteria for the state of residence.

What Is a No-Fault Accident?

The term “no-fault” is used in two ways where vehicle accidents are concerned. For the first application, a no-fault accident is one in which the subject was not to blame for the incident or did not directly cause the car crash.

In some states, fault is treated as black-and-white, where an individual is either “at-fault” or “not-at-fault.” Other states have a gray area where an individual may be considered partially at fault and responsible for a proportional amount of damages.

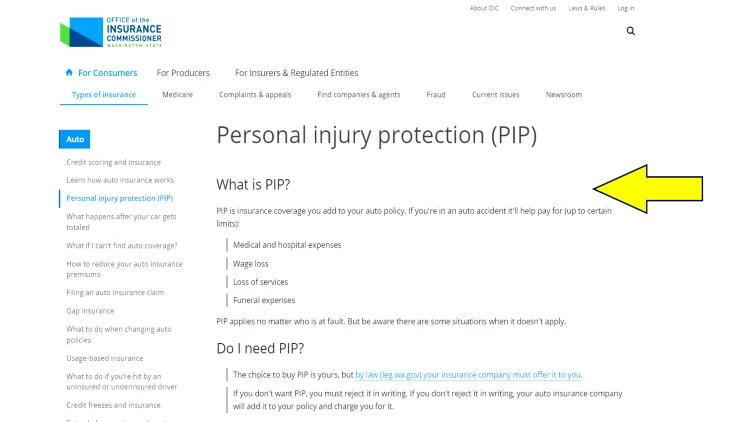

The other, and less understood, use of the term “no-fault accident” refers to an individual’s ability to file a claim with their own insurance company for coverage of medical costs obtained in a no-fault (first definition) accident. A large handful of states across the United States have no-fault accident laws which require individuals to carry personal injury insurance for no-fault accidents. These laws are meant to simplify the compensation process after minor accidents.3

What Are the No-Fault States?

As mentioned above, there are several states which require individuals to carry no-fault insurance (sometimes called personal injury protection insurance [PIP]) to cover their personal medical costs (and that of their passengers) for accidents where they were not at-fault.

Many states require drivers to carry no fault insurance, also called personal injury protection, in order to obtain a license.

This is meant to ensure that an individual’s needs are met and covered after a no-fault accident, regardless of the at-fault party’s insurance coverage status. The no-fault states are:

- Florida

- Hawaii

- Kansas

- Massachusetts

- Michigan

- Minnesota

- New York

- North Dakota

- Utah

Three additional states (Kentucky, New Jersey, Pennsylvania) give drivers the option of choosing no-fault or traditional insurance and are often categorized as “no-fault states”.3 A few other states, such as Delaware and Oregon have provisional PIP insurance which may cover medical costs but not lost wages or pain and suffering.

The flip side of a no-fault state is a “tort state” where the at-fault individual’s insurance company is responsible for all of the damages associated with the accident.9,16

No-Fault Accident Examples

Any type of car accident can be eligible for no-fault insurance coverage in no-fault states. Some no-fault accident examples can include when an individual is rear-ended by a distracted driver, t-boned at an intersection, or even the victim of a drunk driving collision. In no-fault states, the not-at-fault party would file the accident with their PIP insurance coverage for medical costs, pain and suffering, loss of wages, etc. PIP insurance tends to have a lower ceiling and may not cover all medical costs in a very serious accident.3

No Fault Accident: Who Pays? (No Fault Car Accident Settlement)

For individuals living in a “tort” state or fault state, the at-fault party’s insurance pays for all damages including property damages, medical damages, and pain and suffering.9

However, it can take longer than desired for police officers and insurance companies to determine who was at fault in an accident, and it isn’t always clear-cut. For example, the state of Nevada has “modified comparative fault” and “modified comparative negligence” (Nevada Revised Statutes Section 41.141) laws.25

This means that individuals can only recover damages if they are considered less at-fault than the other party, and furthermore, they can only recover damages commensurate with the percentage of responsibility the other party has. In other words, if an individual takes a case to court, and the defendant is judged to be 75% at-fault for the accident, the plaintiff can be rewarded 75% of the damages sought.

Admittedly, this can get a little complicated. No-fault insurance is meant to be a bit simpler.

No fault liability insurance is designed to cover medical costs regardless of who is at fault in an accident.

In a no-fault car accident settlement, individuals must file a claim with their insurance after the accident (there is often a threshold of around $1,000 of damage for required reporting). The not-at-fault party’s PIP insurance will pay for medical costs, lost wages, and other costs associated with an injury for the driver and passengers up to the designated limit.23

In the state of Kentucky, this limit is $10,000 for basic PIP, which can be upgraded (see Kentucky Department of Insurance).26 The at-fault party’s insurance must pay for all property damage and personal injury and may be liable for additional medical costs not covered by the other party’s PIP insurance.9

Do I Have To Pay Deductible if I Was Not at Fault (Progressive)?

Paying a deductible is one of the biggest drawbacks of filing an insurance claim, and many people are curious to know: “Do I have to pay deductible if I was not at fault (Progressive)?” Firstly, if an individual resides in a “tort” or at-fault state, all of their damage claims will be filed with the at-fault party’s insurance company and no deductible will be due. However, individuals living in a no-fault state will have to pay a deductible on their PIP if they file for medical costs, etc.

Individuals can often select the type of PIP insurance they want to carry, and some options may not have deductibles.19

How Long Do Points Stay on Your Driving Record?

The majority of states use a license point system to track traffic violations over time and ensure that repeat offenders receive the proper penalties, such as license suspension or revocation.

Most states create a points system for drivers that add up for every violation.

Answering “How long do points stay on your driving record?” requires a look at each state’s point system. However, many states (Kentucky, Ohio, Indiana) maintain license points for two years from the date of the conviction.

Other states maintain points for up to 5 years, but 2 to 3 years is the average.14, 10, 15

Will a Car Accident Show Up on a Background Check?

Perhaps it’s time to change jobs or rent a new place and an individual who was in an accident is concerned, questioning “Will a background check uncover any past car accidents?” The truth is that it can, but it isn’t all that likely. It all depends on what the background check is looking at.

Employment background checks often examine criminal records, but remember that car accidents only show up on criminal records in at-fault cases where there was some related criminal activity (DUI, hit and run, reckless driving, etc.) and a criminal citation was issued. Even in those cases, many background checks won’t look back further than 7 to 10 years, so accidents from long ago are unlikely to show up.13

Sometimes, background checks look at driving records. When this happens, any accident within the last couple of years will probably be visible.

How Does a No-Fault Accident Affect Insurance? (Will a Non-Fault Accident Affect My Insurance?)

At this point, many people are probably wondering “Will a non-fault accident affect my insurance?” and “How does a no-fault accident affect insurance?” These two questions can be answered simultaneously with one important distinction. If the individual lives in a no-fault state, a no-fault or non-fault accident (where personal injury was incurred) will affect their insurance. If the individual lives in a tort state, a non-fault accident will not affect their insurance.3

The degree to which a no-fault accident affects an individual’s insurance rates depends upon their previous driving record, the state of residence, and the severity of the accident (magnitude of the claim).2

Knowing how to file a claim with another driver’s insurance company can be tricky, but most states offer free information for how to accomplish it.

Insurance premiums should not increase to the same extent as they would for an at-fault claim.

How Do I File a Not-At-Fault Collision Claim (GEICO)?

An individual only needs to file a not-at-fault collision claim (GEICO) in the no-fault states where PIP insurance is required. In the other 38 states, the at-fault party’s insurance is responsible for all damages. However, individuals with collision coverage may still choose to file a collision claim for damages to their vehicle, regardless of who is at fault. Collision coverage is also useful when the at-fault party is under-insured.6

To file a claim with GEICO, individuals can use GEICO’s mobile app, their website, or call by phone at (800) 841-3000.7 Be sure to file the claim as soon as possible to ensure that the details of the accident are still fresh.

How Long Does a Car Accident Stay on Your Insurance Record?

To answer the question “How long does a car accident stay on your insurance record?,” two pieces of information are required: 1. Does the state use a licensing point system? And 2. How serious was the accident?

In states where a license point system is employed, insurance companies often use license points to determine premiums and rate increases. Therefore, a car accident is likely to affect insurance rates for a period of 2 to 5 years. States which do not have a license point system tend to have similar rules in place (see Oregon Division of Financial Regulation), and 3 years seems to be the average.27

However, serious accidents, particularly those where the individual was at-fault or received a criminal citation may continue to impact insurance rates many years down the road.

How To Remove a Non Fault Accident on Driving Record

Anyone who wants to find out how to remove a non-fault accident on their driving record should contact their state DMV, as regulations and protocol can vary significantly from place to place.

In most cases, an individual will simply have to wait until the time expires or the points fall off the driving record. However, a DMV may sometimes allow a person to attend traffic school and petition to have the record removed or expunged early.12

Find the link to the Department of Motor Vehicles or equivalent institution for each state in the following table.

What Must You Do if You Are At Fault in an Accident and Do Not Have Insurance?

In all states but two (New Hampshire and Virginia), drivers are required to maintain liability car insurance at a minimum.5 Yet, there are regular incidents where individuals drive without insurance and sometimes find themselves involved in an accident. So what must you do if you are at fault in an accident and do not have insurance?

Some larger cities, like San Diego, make it easy to find traffic accident report, tickets, and other law enforcement services online.

There are a few steps to follow.8

- As with any car accident, stop immediately and wait at the scene of the crash (a hit-and-run is a more serious charge than driving without insurance).

- Call emergency services if anyone is seriously injured.

- Call police to the scene.

- Exchange contact information with other parties.

- Get contact information for any witnesses.

- Take pictures of the scene.

- Do not talk about the accident at the scene.

- Contact a good defense lawyer.

What Does a Progressive At-Fault Accident Look Like?

For individuals insured by Progressive, at-fault accidents are sure to increase your insurance (as with any insurance company) and are likely to increase by 28%, on average. Insurance premiums typically rise more for at-fault accidents, but Progressive does offer some accident forgiveness.

Small accident forgiveness ($500 or less) is available to most new and existing customers. Large accident forgiveness benefits are available in some states to individuals who have not received traffic citations or been involved in traffic accidents for 5 years.18

Most individuals will be involved in a car accident at some point in their lives, and in many cases, someone else will be at-fault.

However, in no-fault states where individuals are required to file accidents with their own personal injury protection (PIP) insurance, policyholders can still expect to see insurance rates go up even after a non-fault accident. Revisit this article to find out “When does a no fault accident go on your record?”

Frequently Asked Questions About Does a No Fault Accident Go on Your Record